Malaysia’s food and beverage players are moving fast and not for a new flavour launch. As electricity tariffs climb and sustainability becomes a must-have, more manufacturers are switching to solar energy to survive rising costs and stay competitive in global markets. This isn’t a “green trend” anymore. It’s a business strategy.

In the F&B sector where margins are already super tight, solar is becoming the one move that protects both the bottom line and the brand. Here’s why this shift is happening now across Malaysia.

⚡ Rising Electricity Costs Are Pushing Manufacturers Toward Solar

Electricity tariffs have been climbing steadily, squeezing manufacturers who already juggle labour, logistics and raw material hikes.

According to the Federation of Malaysian Manufacturers:

- 41 percent saw energy costs jump up to 10 percent in 2023

- 36 percent faced similar increases in raw materials

When you’re operating on thin margins, even small spikes hit the bottom line hard. For many F&B businesses, solar is no longer a “nice idea” it’s the only way to stabilise operating costs over the long term.

But cost pressures are only one part of the story.

🌏 Sustainability Now Decides Which Brands Stay Competitive

Global buyers are shifting hard toward low carbon producers. Investors are asking tougher ESG questions. Import markets want proof, not promises.

If manufacturers can’t show progress:

- they lose deals

- they lose investor confidence

- they lose access to sustainable supply chains

Malaysia’s F&B companies are realising that energy choices directly influence their survival. Solar has moved from environmental CSR to boardroom-level urgency.

🍹 A Local Example: Double Lion Takes the Leap

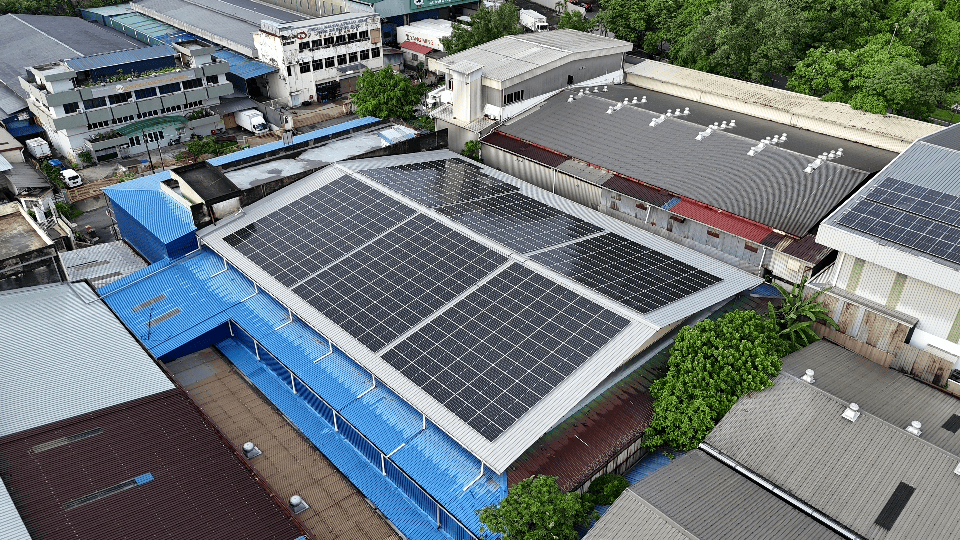

K.H.H. Double Lion Fruit Juice Manufacturing the name behind the Ros Sirap many Malaysians grew up drinking recently made the transition to solar with renewable energy provider EFS Group.

The panels now support about 40 percent of the company’s production floor energy needs.

The impact:

- predictable electricity costs

- insulation from future tariff spikes

- stronger sustainability credentials for buyers

“Solar helped us solve two problems at once,” said Karin Tan, Director of K.H.H. Double Lion. “We locked in stable operating costs and proved that sustainability is something we take seriously. This is no longer optional for us.”

EFS Group CEO Darren Tan says this reflects a bigger shift across Malaysia:

“Solar used to be something companies did to win CSR awards. Today, it’s about future proofing the business.”

🇲🇾 Malaysia’s Energy Policy Is Speeding Up the Transition

The push isn’t just coming from businesses. Malaysia’s national energy roadmap is designed to accelerate adoption.

By 2050, the energy transition could contribute:

- RM220 billion to GDP

- 310,000 new green jobs

- RM1.2–1.3 trillion in investment opportunities

The new Solar ATAP programme, effective 1 December, allows businesses to install solar systems up to 100 percent of their maximum demand and sell excess energy to the grid. It replaces NEM but keeps the same spirit of encouraging adoption, now with more realistic pricing and optimised offsets.

Existing NEM users can move into:

- Solar for Self Consumption (SelCo)

- Community Renewable Energy Aggregation Mechanism (CREAM)

- Energy storage solutions

Malaysia isn’t just promoting solar as a green initiative, it’s building an economy shaped around it.

🏭 Solar Is Now a Competitive Imperative

For Malaysia’s food and beverage sector, the shift is clear:

Profitability and sustainability are now the same conversation.

Early adopters secure:

- stable long-term energy costs

- priority with eco responsible buyers

- stronger brand trust

- better resilience against future regulations

Companies like Double Lion prove that solar adoption is possible even for legacy manufacturers with modest facilities. It just requires urgency because the market is changing faster than ever.

Malaysia’s target of hitting 40 percent renewable energy by 2035 means the clock is ticking. F&B manufacturers who move now will shape the industry’s future. Those who wait risk falling behind in markets where sustainability has become the baseline expectation.

The transition is no longer “if”. It’s “how fast can you move”.